What to Expect From TKO Group Q2 2025 Earnings Report

Valued at a market cap of $33.4 billion, TKO Group Holdings, Inc. (TKO) is a premier sports and entertainment company formed through the 2023 merger of UFC and WWE, and majority-owned by Endeavor Group. Headquartered in New York, TKO oversees globally recognized brands including UFC, WWE, and PBR, hosting over 500 live events annually across 210+ countries.

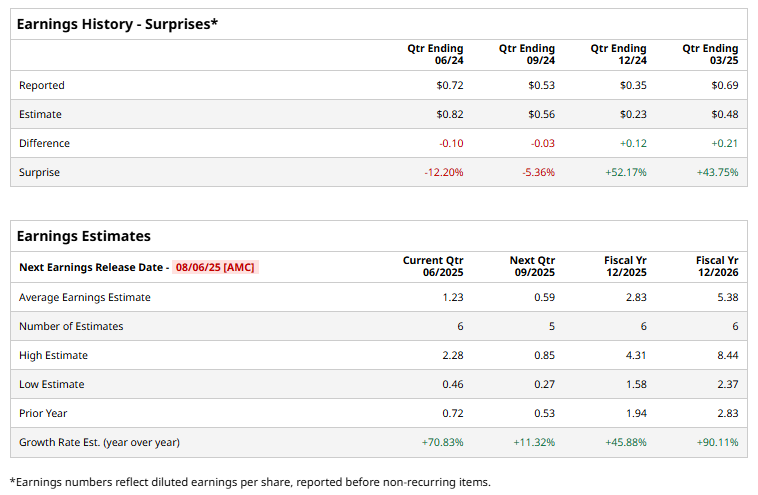

The company is expected to unveil its Q2 2025 earnings after the market closes on Wednesday, Aug. 6. Ahead of this event, analysts project TKO to report a profit of $1.23 per share, a rise of 70.8% from $0.72 per share reported in the year-ago quarter. While the company has surpassed Street's bottom-line estimates in two of the past four quarters, it fell short of expectations on two other occasions.

For fiscal 2025, analysts forecast TKO Group to report an EPS of $2.83, marking an increase of 45.9% from $1.94 reported in fiscal 2024. Moreover, in fiscal 2026, its earnings are expected to surge 90.1% year-over-year to $5.38 per share.

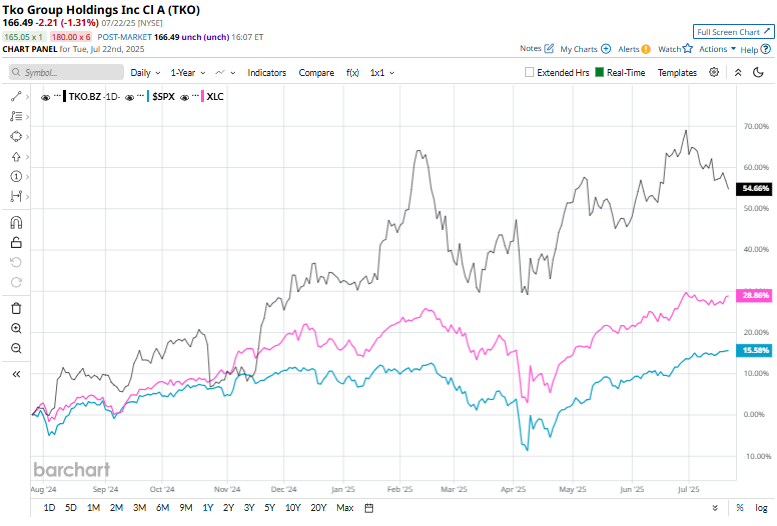

TKO stock has surged 57.6% over the past 52 weeks, significantly outperforming the S&P 500 Index’s ($SPX) 13.4% gain and the Communication Services Select Sector SPDR ETF Fund’s (XLC) 26.2% rise during the same time frame.

TKO Group released its Q1 2025 earnings on May 8, and its shares slipped 5.5% the following trading session. It posted revenue of $1.3 billion and net income of $165.5 million, a significant rebound from a $234.5 million loss in the same quarter last year. Adjusted EBITDA rose 23% year-over-year to $417.4 million, fueled by strong performances from both WWE and UFC. The company also raised its full-year outlook, projecting 2025 revenue to reach up to $4.6 billion, aided by the recent additions of IMG, On Location, and PBR.

Analysts' consensus view on TKO stock is very bullish, with a "Strong Buy" rating overall. Out of 19 analysts covering the stock, opinions include 15 "Strong Buys" and four "Holds.” Its mean price target of $189.33 suggests an 13.7% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.