What to Expect From Axon Enterprise's Next Quarterly Earnings Report

/Axon%20Enterprise%20Inc%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $57.8 billion, Axon Enterprise, Inc. (AXON) develops and sells conducted energy devices under the TASER brand, along with a suite of software and sensor technologies for public safety. Operating through its TASER and Software & Sensors segments, it provides hardware, cloud-based solutions, and services to law enforcement and a range of security-related industries worldwide.

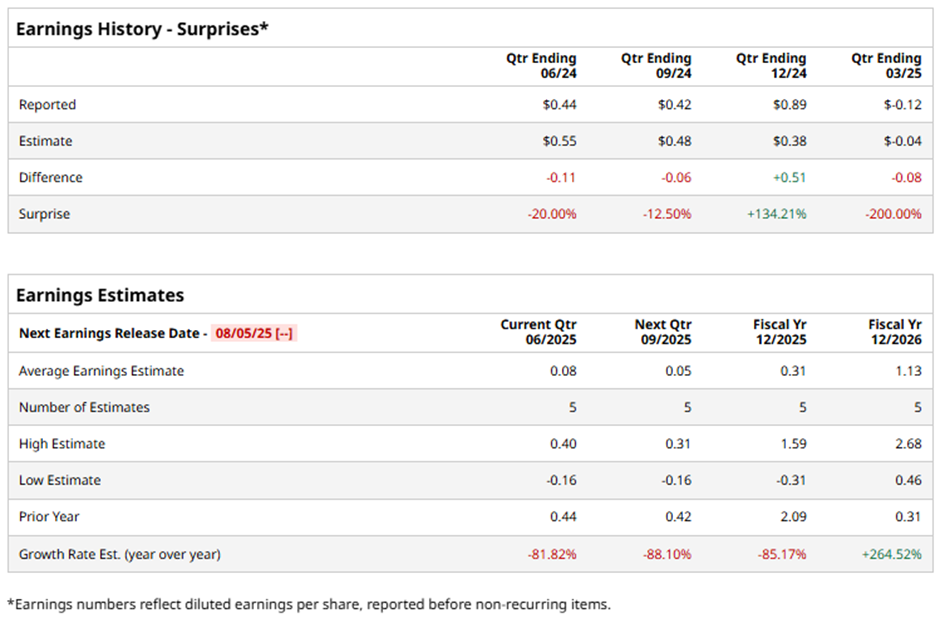

The Scottsdale, Arizona-based company is expected to release its fiscal Q2 2025 earnings results on Tuesday, Aug. 5. Ahead of this event, analysts project AXON to report an EPS of $0.08, an 81.8% drop from $0.44 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in one of the last four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast the law enforcement vendor to report EPS of $0.31, down 85.2% from $2.09 in fiscal 2024. However, EPS is expected to rebound and grow significantly, 262.5% year-over-year to $1.13 in fiscal 2026.

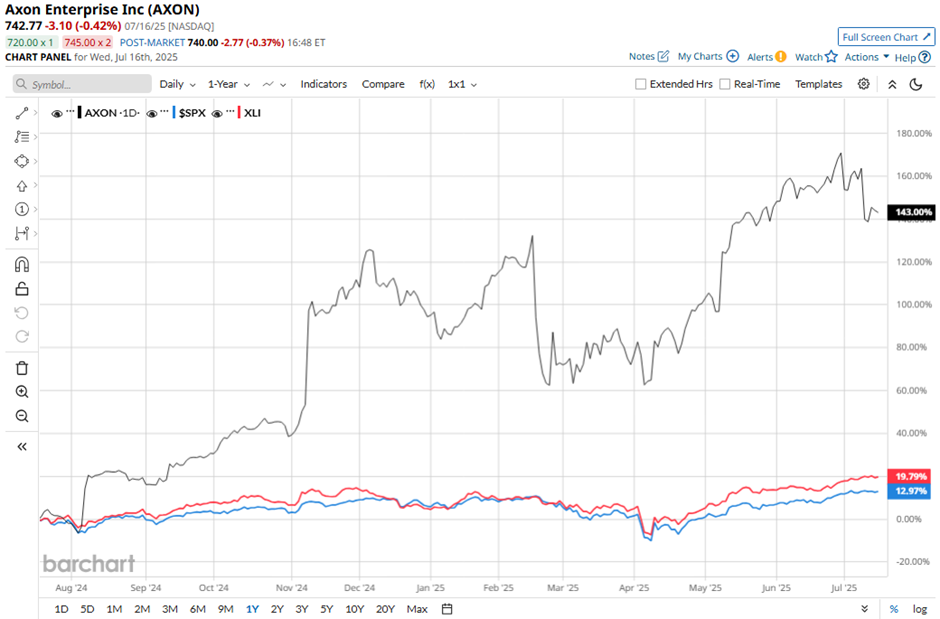

Shares of Axon Enterprise have surged 132.5% over the past 52 weeks, significantly outperforming the broader S&P 500 Index's ($SPX) 10.5% return and the Industrial Select Sector SPDR Fund's (XLI) 17.3% gain over the same period.

Shares of Axon Enterprise surged 14.1% after the company reported strong Q1 2025 results on May 7. The company delivered record revenue of $603.6 million, marking a 31% increase year-over-year, while adjusted EPS reached $1.41, both exceeding analyst expectations. Annual recurring revenue climbed 34% to $1.1 billion, with software revenue leading the way with 39% growth, highlighting the strength of Axon’s high-margin business model.

Moreover, Axon raised its full-year revenue guidance to a range of $2.6 billion to $2.7 billion and adjusted EBITDA to between $650 million and $675 million, further fueling investor optimism.

Analysts' consensus view on AXON stock is bullish, with an overall "Strong Buy" rating. Among 17 analysts covering the stock, 11 suggest a "Strong Buy," three give a "Moderate Buy," and three provide a "Hold" rating. As of writing, the stock is trading below the average analyst price target of $745.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.