Can This Cheap AI Stock Bounce Back After May 1?

/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

In a volatile market, growth stocks remain a risky investment choice. Even though some have the potential to generate significant returns over time, they are better suited to investors with a long-term investment horizon, as these companies may take time to reach their full potential.

One such growth stock is Twilio (TWLO). It provides APIs that developers can integrate into their apps, websites, or services to instantly send messages, make calls, and handle other communications. Twilio’s stock has taken a wild ride, from meteoric gains during the pandemic tech boom to a sharp decline as market realities changed. Year to date, TWLO is down 10.8%, compared to the broader market’s loss of 6.1%. However, Wall Street expects the company to report another strong quarter on May 1, with double-digit earnings growth, which could help its stock recover.

Now that Twilio is focusing on profitable growth and a leaner business model, is it a good time to buy?

Instead of having to build complicated telecom systems, businesses can simply “plug in” Twilio’s services to their app or website. This business model made Twilio indispensable for thousands of businesses across industries. Between 2014 and 2024, Twilio’s revenue increased from $88.8 million to $4.46 billion. However, the company also invested heavily in sales, marketing, product development, and acquisitions such as Segment ($3.2 billion), with the goal of expanding its offerings beyond basic communication, resulting in consistent net losses.

In the fourth quarter, revenue increased 11% year-over-year to $1.19 billion, beating consensus estimates by $12.7 million. For the full year, revenue rose 7% in 2024. Disciplined cost management has resulted in a 50% increase in adjusted profit to $3.67 for the full year 2024. The company also generated $93.5 million in free cash flow in the fourth quarter and $657.7 million for the full year 2024. Twilio also maintains a strong balance sheet, with $2.38 billion in cash and short-term investments at the end of 2024.

Recently, the company collaborated with Cedar to improve the patient billing experience by leveraging AI-powered communication tools. The goal is to reduce administrative costs for healthcare providers while also making billing more intuitive and patient-friendly, particularly as out-of-pocket costs rise. Furthermore, it collaborated with Singtel to introduce secure, branded Rich Communication Services (RCS) messaging for Singapore businesses. This move improves Twilio’s global RCS rollout.

Management anticipates 10% to 16% growth in earnings and 7% to 9% growth in revenue in the first quarter. Analysts covering Twilio expect revenue to grow by 8.7% to $1.14 billion in the first quarter, followed by a 20% earnings increase.

Twilio stock, which trades at 21 times forward 2025 earnings, appears to be a cheap AI stock to buy right now.

Is TWLO Stock a Buy, Hold, or Sell on Wall Street?

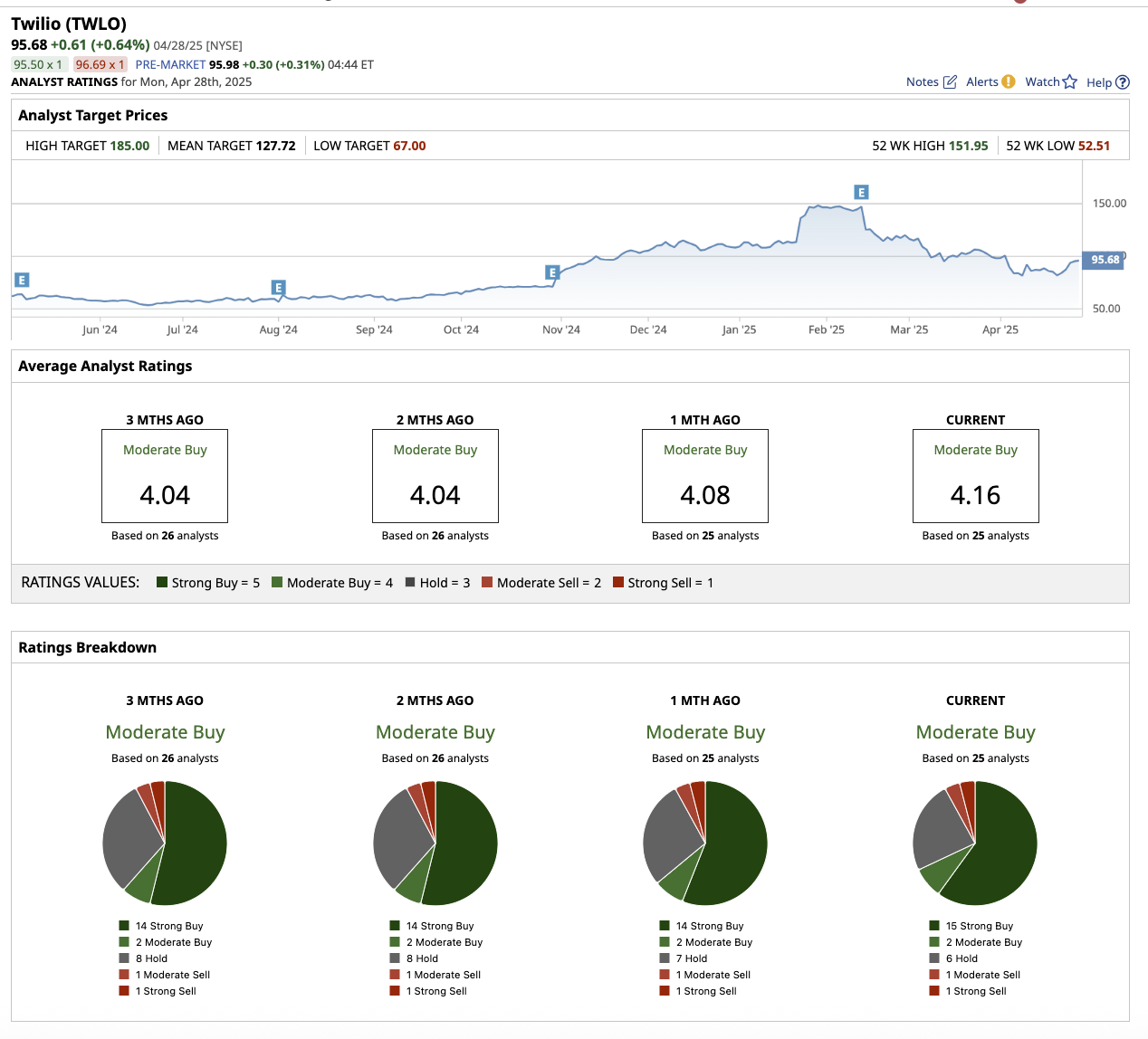

Overall, the stock is a “Moderate Buy” on Wall Street. This month, analysts at Jefferies, Scotiabank, Oppenheimer, Wells Fargo, and many others lowered the price target for Twilio stock.

Recently, Stifel Nicolaus analyst J. Parker Lane maintained his “Hold” rating on the stock with a target price of $110. Lane notes that Twilio has successfully integrated RCS capabilities into its product suite. Nonetheless, the RCS ecosystem remains immature. Lane believes that while the company’s strategic positioning in digital communications is evolving, the near-term investment case appears to be one of caution rather than aggressive buying.

Separately, TD Cowen analyst Derrick Wood has maintained a “Hold” rating while reducing the target price to $100. Wood believes Twilio’s consumption-based revenue model exposes it to economic headwinds such as global trade tensions and slowing consumer spending. However, Wood notes that Twilio’s AI initiatives provide a glimpse of long-term potential, justifying the “Hold” rating.

Out of the 25 analysts covering the stock, 15 rate it a “Strong Buy,” two say it’s a “Moderate Buy,” six rate it a “Hold,” one says it’s a “Moderate Sell,” and one recommends a “Strong Sell.” Its mean target price of $127.72 suggests the stock can climb 33% from current levels. Its Street-high estimate of $185 implies an upside potential of 93% over the next 12 months.

Twilio, despite its attractive valuation, may not be the best stock for investors seeking momentum and hypergrowth. For now, Twilio remains a “wait and see” story as it navigates macroeconomic challenges while focusing on consistent profitability and positive cash flow.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.