Is Mohawk Industries Stock Underperforming the S&P 500?

/Mohawk%20Industries%2C%20Inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $7.3 billion, Mohawk Industries, Inc. (MHK) is a flooring manufacturer that creates products to enhance residential and commercial spaces around the world. The Calhoun, Georgia-based company operates through three segments: Global Ceramic; Flooring North America; and Flooring Rest of the World.

Companies valued at less than $10 billion are generally classified as “mid-cap stocks," and Mohawk Industries fits this criterion perfectly. The company offers its products to home centers, company-owned service centers and stores, floor-covering retailers, ceramic tile specialists, e-commerce retailers, residential builders, independent distributors, commercial contractors, and commercial end users.

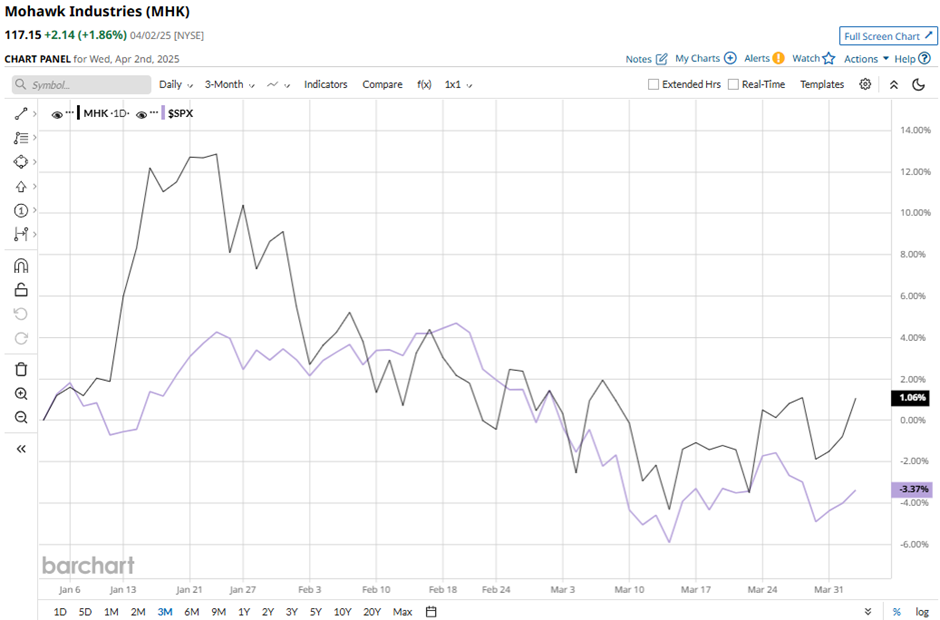

The flooring maker dropped 28.7% from its 52-week high of $164.29. Mohawk Industries stock has gained nearly 1.1% in the past three months, surpassing the S&P 500 Index’s ($SPX) 3.4% decrease.

MHK has declined 26.6% over the past six months, while SPX fell marginally. Similarly, shares of Mohawk Industries have fallen 6.4% over the last 52 weeks, failing to keep pace with the SPX’s 8.9% surge in the same timeframe.

The stock has been trading below its 200-day moving average since December.

In spite of Mohawk Industries exceeding Q4 2024 expectations on Feb. 6, its stock fell 1.3% the next day. The company outperformed Wall Street projections in Q4, posting an adjusted EPS of $1.96 against the expected $1.88. Revenue reached $2.6 billion, also exceeding the consensus. Its Global Ceramic Segment, net sales increased 1.5% year-over-year, along with the North American flooring segment, which grew by 2.8% year-over-year. In addition, MHK expects first-quarter adjusted EPS to be between $1.34 and $1.44.

Moreover, when compared, MasterBrand, Inc. (MBC) performed weaker than MHK over the past 52 weeks, decreasing by nearly 25.4%. However, shares of MBC collapsed 25.4% over the past six months, almost aligning with MHK.

Despite MHK’s underperformance compared to the SPX over the past year, analysts are moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 15 analysts covering it, and it is currently trading below the mean price target of $142.27.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.