Corn Futures Rally After Surprisingly Bullish USDA Report

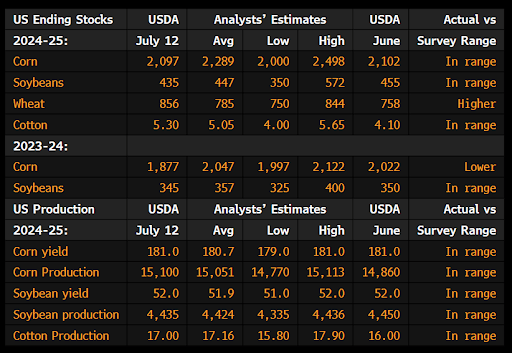

Corn futures were able to round out the week on a positive note with December corn futures settling 4 cents higher to 414 3/4, that was 11 3/4 cents off the intraday low, but still 9 1/4 cents lower. Today’s rally came on the back of a better than feared USDA report which showed bigger than expected drops in old crop and new crop ending stocks. Old crop stocks came in at 1.877 billion bushels, that was well below the average estimate of 2.049 billion bushels. New crop ending stocks came in at 2.097 billion bushels, down from the average estimate of 2.312 billion bushels. Perhaps the biggest surprise from these numbers was really a lack luster response through the afternoon trade. At the very least, it certainly shakes up the conversation a bit and perhaps can spark a little more of a two-sided trade, (vs what has felt like a one-sided move lower).

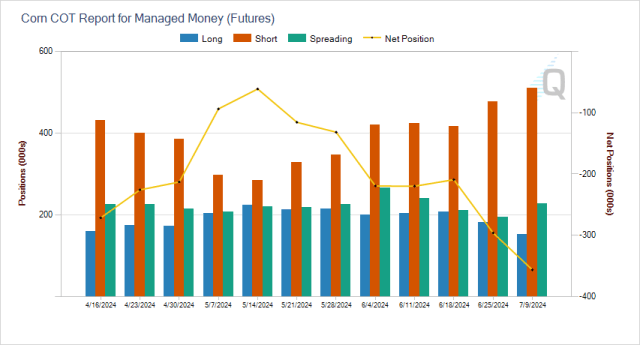

Friday’s weekly Commitment of Traders report showed funds were net sellers of about 17.5k futures and options contracts through Tuesday’s trade, expanding their net short to 356,415 contracts, that’s enough for new record net short. Broken down that is a whopping 509,165 shorts VS 152,750 longs.

Below is a look at the one-hour chart of December corn futures (on our Blue Line Edge trading platform, free to brokerage clients). As you can see, today’s price action may have not met expectations relative to the report, but it was enough to at least get us back above our pivot pocket from 412-413. So long as the Bulls can defend this pocket, we could see futures try to repair more of the technical damage that has been done over the last several weeks. 420-422 is the next hurdle for the Bulls to overcome, a move above here could spur more short covering regardless of the fundamental landscape. Above that pocket and the next upside target would be a full retracement of the breakdown point from the quarterly stocks report which comes in closer to 432.

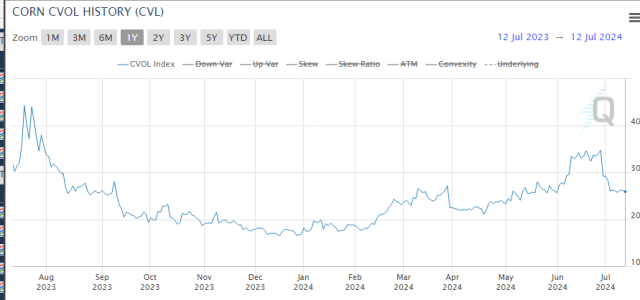

So, what are a few ways to play for a counter trend trade in the corn market? That depends on an individual’s risk profile (account size, risk appetite, risk capital, trading objectives, etc), so to lay out a one size fits all strategy is something we’ll avoid doing for a public post (call our trade desk to discuss a strategy suitable for you!). With that said, for a counter trend trade setup we like to look to the options market as a way to help gain some exposure while minimizing the risk. Looking at the CME Group CVOL index for corn, we see volatility (imagine it as a measure of fear/uncertainty) well off the highs from June, which may make options “more affordable”. For reference, it looks like the October $4.20 call option (that trade off December futures) last traded at 13 1/4 cents, those options have 70 days until expiration.

CLICK THIS LINK TO OPEN YOUR ACCOUNT WITH BLUE LINE FUTURES TODAY!

Whether you’re looking to trade on your own or work with a professional trade desk, Blue Line Futures has the technology and service to help meet your needs!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

On the date of publication, Oliver Sloup did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.