SoFi Stock: Does an Outstanding Q4 Make This Fintech a Buy Now?

Founded in 2011, SoFi Technologies (SOFI) is a financial technology (fintech) company that integrates borrowing, investing, saving, financial planning, and more. While the company began its journey by offering student loan refinancing options, it has since expanded to include personal loans, banking services, investing and wealth management, and mortgage lending, among other services. What's more impressive is that SoFi's annual adjusted net revenue has increased by more than eight times since fiscal 2018.

Fintech companies generally struggled last year due to rising interest rates. However, SoFi's ability to adapt to changing financial trends has made it a resilient company to thrive and survive through economic cycles, with its stock surging 115% last year.

Now, with the integration of artificial intelligence (AI) across almost every industry, fintech companies' growth opportunities are on the rise. SoFi was unprofitable up until now, which may help to explain Wall Street's neutral outlook on the stock.

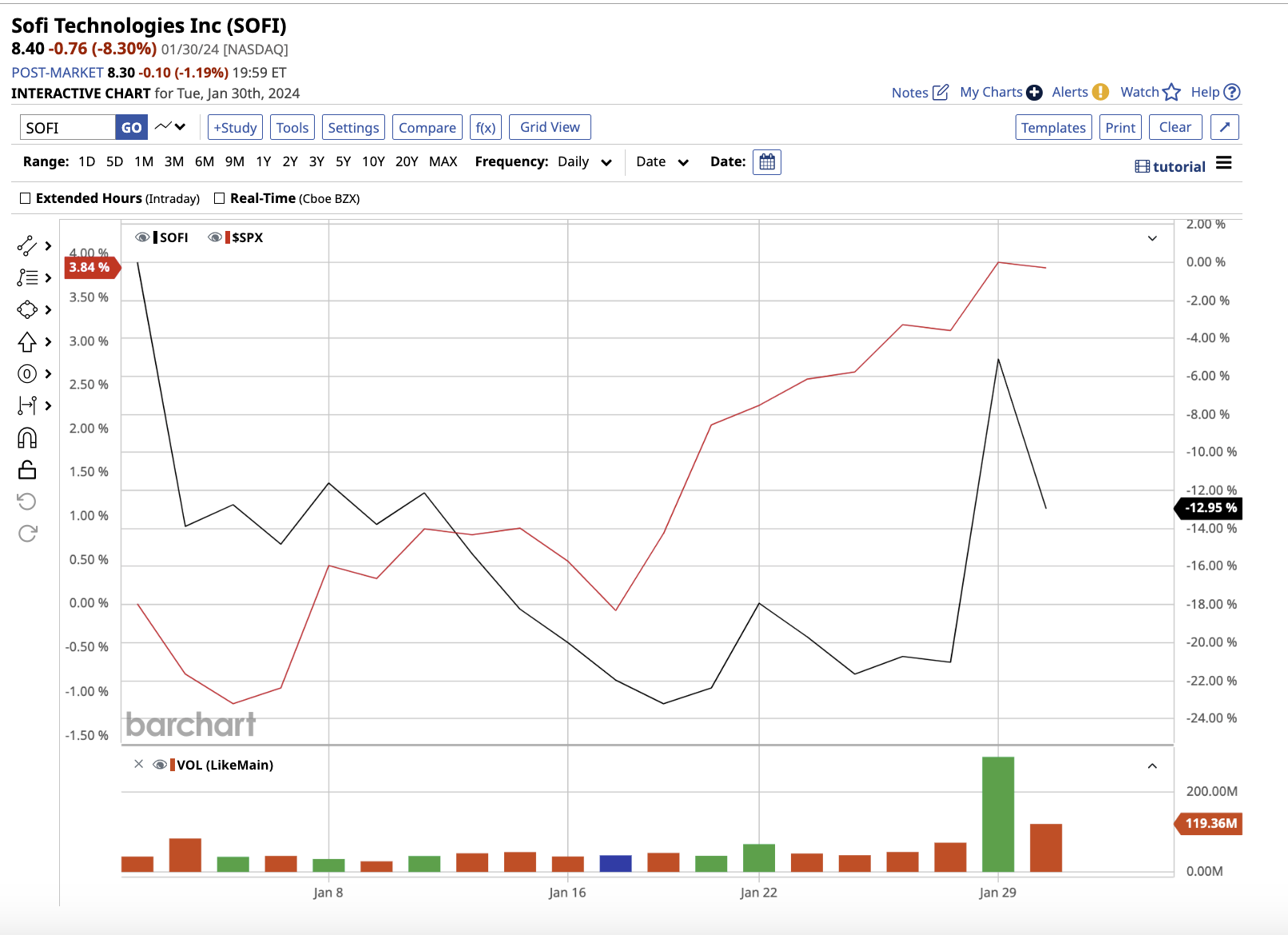

However, in its fourth quarter results, the company reported a profit under GAAP (generally accepted accounting principles), beating consensus estimates while also painting a bright outlook for 2024 and beyond. While SOFI stock skyrocketed 20% post-earnings, the stock is down 19% year-to-date, compared to the S&P 500 Index’s ($SPX) modest gain.

Let’s find out if SoFi’s fourth-quarter results make the stock a buy now.

SoFi Reports a Blockbuster Quarter

Despite geopolitical and macroeconomic headwinds weighing on most fintech companies, SoFi reported a record-breaking end to 2023. The credit goes to its comprehensive financial platform, which offers a wide range of services, from student loan refinancing to investment management and more.

In the fourth quarter, SoFi added 585,000 members, bringing the total number of members to over 7.5 million. Moreover, the addition of 695,000 products drove a surge of 41% year-over-year in total products to 11.1 million. This strong growth in its customer base spurred a 34% year-over-year increase in adjusted revenue to $594 million.

Notably, SoFi runs its business through three segments: Lending, Technology Platform, and Financial Services. CEO Anthony Noto highlighted that all three segments delivered record revenue in the quarter. The Lending segment contributed the most, adding $346.5 million to the overall increase in adjusted revenue.

The Financial Services segment, in particular - which offers checking and savings accounts, debit and credit cards, and cash management products - increased revenue an impressive 115% year-over-year. This explosive growth resulted in its first quarter GAAP profit of $47.9 million, or earnings per share (EPS) of $0.02, compared to a loss of $40 million in the prior-year quarter.

What's Next for SOFI Stock?

Driven by a strong finish to the year, management now expects adjusted net revenue of $550 million to $560 million in the first quarter of 2024, with GAAP net income of $10 million to $20 million.

For the full year 2024, SoFi anticipates its lending segment revenue will increase by 92% to 95%, while its non-lending segment combined is expected to grow by 50%. GAAP earnings for the year could range between $0.07 and $0.08 per share. Meanwhile, analysts predict revenue growth of 15.8% to $2.4 billion for the year, with EPS of $0.06.

Not only that, management’s optimistic outlook extends beyond 2024, projecting compounded revenue growth of 20% to 25% between 2023 and 2026. Furthermore, the company believes that its core business, combined with new products introduced this year, could result in a 20% to 25% increase in EPS beyond 2026.

No doubt, the targets may seem a little far-fetched. However, SoFi's membership and revenue have been steadily increasing, and the company is now profitable. Furthermore, federal loan repayments resumed in October last year, creating refinancing opportunities for SoFi. The company has also implemented AI to innovate, expand its product offerings, and improve its platform.

SoFi recently announced that its members can now invest in mutual funds, money market funds, and select alternative investments. As a result, I believe SoFi has a chance of meeting both its short- and long-term goals.

What Does Wall Street Say About SOFI Stock?

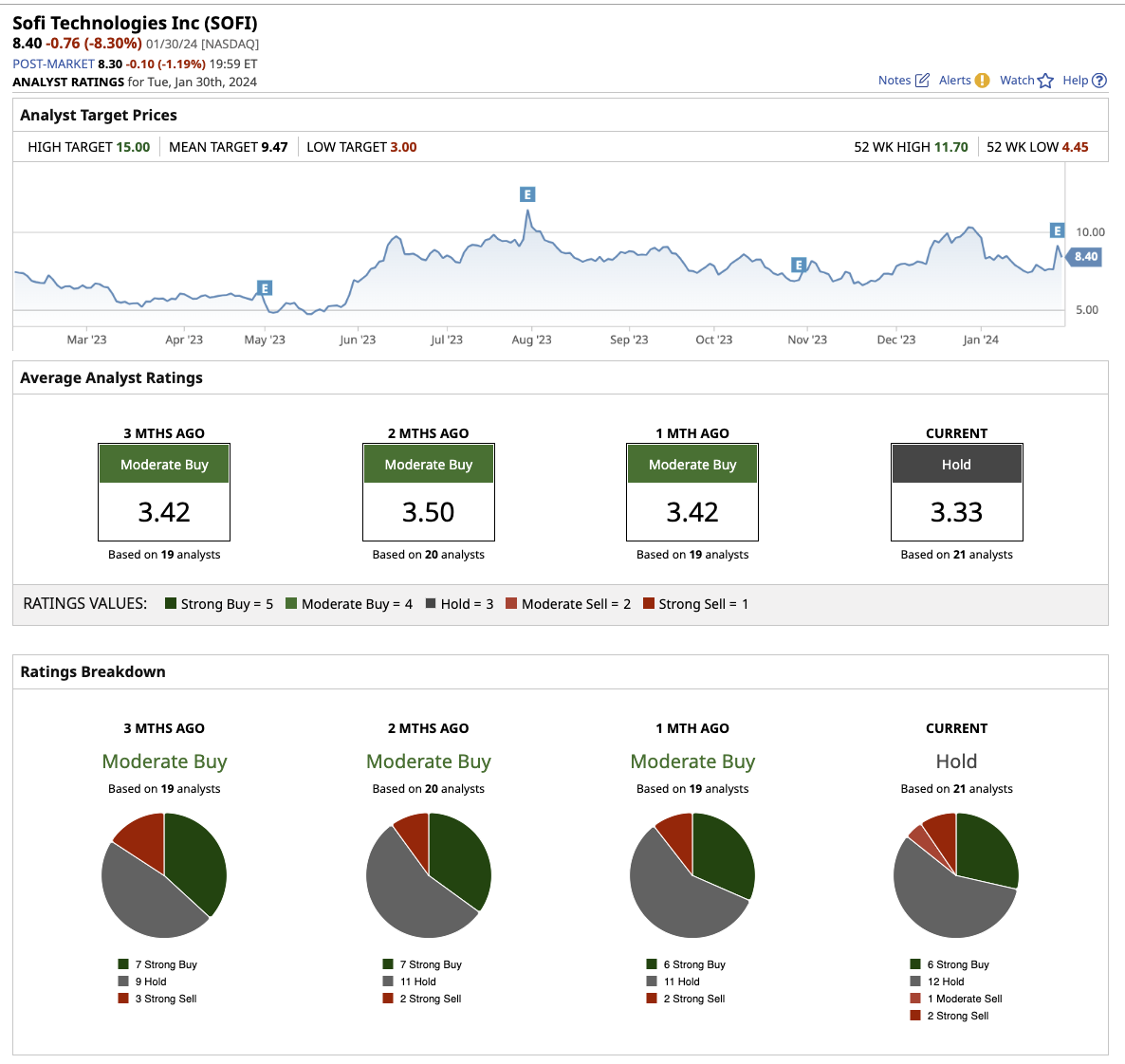

Overall, Wall Street has a “hold” rating for SOFI stock. Out of the 21 analysts covering the stock, six have a “strong buy” recommendation, 12 suggest a “hold,” one analyst suggests a “moderate sell,” and two recommend a “strong sell.” The average price target of $9.47 implies a potential upside of about 18% in the next 12 months. What’s more, the Street-high target price of $15 implies a potential upside of 88% from current levels.

Currently, SOFI stock is valued at 3.6x forward sales, compared to its three-year historical price-to-sales ratio average of 6.4x. SoFi seems like a fairly valued growth stock, based on its growth potential.

The Key Takeaway on SOFI Right Now

Despite the exceptional fourth-quarter results and an upbeat outlook, the majority of analysts continue to rate the stock as "hold," which is not necessarily a bad sign. However, I believe it is still not too late to buy SOFI stock, as when macroeconomic headwinds subside, doors of opportunity will open for the company - resulting in a higher surge in revenue and profits.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.